Veterans Services & Benefits

Sale of armories.

Authorizes transfer, exchange, or sale of seven armories with DGS and Adjutant General approval. Lists seven armories by location and acreage. Proceeds go to the Armory Fund for armory-related uses pending appropriation. Remains governed by the Armory Fund framework and requires future appropriation.

Sale of armories.

Authorizes transfer, exchange, or sale of seven armories with DGS and Adjutant General approval. Lists seven armories by location and acreage. Proceeds go to the Armory Fund for armory-related uses pending appropriation. Remains governed by the Armory Fund framework and requires future appropriation.

Veterans: educational assistance.

Establishes a new state agency to oversee educational programs for veterans in California. Authorizes the Department of Veterans Affairs to create and update regulations for veterans' education programs. Grants the Secretary of Veterans Affairs authority to approve educational organizations for veteran benefits.

Veterans: educational assistance.

Establishes a new state agency to oversee educational programs for veterans in California. Authorizes the Department of Veterans Affairs to create and update regulations for veterans' education programs. Grants the Secretary of Veterans Affairs authority to approve educational organizations for veteran benefits.

Governor’s Military Council.

Extends the repeal date for the Governor's Military Council to 2031 unless a later statute extends it. Adds formal nominations by the Senate Rules Committee and the Speaker for council members. Maintains the council as an advisory body under the Military Department focused on retaining installations. Requires fiscal committee review and imposes no new appropriation.

Governor’s Military Council.

Extends the repeal date for the Governor's Military Council to 2031 unless a later statute extends it. Adds formal nominations by the Senate Rules Committee and the Speaker for council members. Maintains the council as an advisory body under the Military Department focused on retaining installations. Requires fiscal committee review and imposes no new appropriation.

Liens: harvested crops.

Expands farm worker lien rights for unpaid wages to cover all agricultural business structures. Allows workers to place liens on harvested crops for up to two weeks of unpaid wages. Limits total liens to 25 percent of the crop's fair market value. Permits employers to avoid liens by providing a wage payment bond to the Labor Commissioner.

Liens: harvested crops.

Expands farm worker lien rights for unpaid wages to cover all agricultural business structures. Allows workers to place liens on harvested crops for up to two weeks of unpaid wages. Limits total liens to 25 percent of the crop's fair market value. Permits employers to avoid liens by providing a wage payment bond to the Labor Commissioner.

Veterans.

Increases the maximum county burial assistance for indigent veterans from $350 to $1,000. Authorizes counties to provide financial support for burial or cremation expenses of qualifying veterans. Uses existing county funds to cover the increased burial and cremation benefit amounts.

Veterans.

Increases the maximum county burial assistance for indigent veterans from $350 to $1,000. Authorizes counties to provide financial support for burial or cremation expenses of qualifying veterans. Uses existing county funds to cover the increased burial and cremation benefit amounts.

Sales and use taxes: exemptions: California Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project: transit buses.

Extends the sales tax exemption for zero-emission transit buses purchased by public agencies until January 1, 2028. Applies to various transit vehicle types including articulated, double-decker, and trolley buses over 14,000 pounds. Requires buses to qualify for the state's Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project. Takes effect immediately to help public agencies transition to zero-emission transit fleets.

Sales and use taxes: exemptions: California Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project: transit buses.

Extends the sales tax exemption for zero-emission transit buses purchased by public agencies until January 1, 2028. Applies to various transit vehicle types including articulated, double-decker, and trolley buses over 14,000 pounds. Requires buses to qualify for the state's Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project. Takes effect immediately to help public agencies transition to zero-emission transit fleets.

Property taxation: exemption: low-value properties.

Increases the property tax exemption limit from $10,000 to $20,000 for low-value properties from 2026 to 2031. Authorizes county boards to exempt properties when tax collection costs exceed potential revenue. Requires the State Board of Equalization to track and report annually on exemption impacts. Eliminates state reimbursement to local agencies for lost property tax revenue.

Property taxation: exemption: low-value properties.

Increases the property tax exemption limit from $10,000 to $20,000 for low-value properties from 2026 to 2031. Authorizes county boards to exempt properties when tax collection costs exceed potential revenue. Requires the State Board of Equalization to track and report annually on exemption impacts. Eliminates state reimbursement to local agencies for lost property tax revenue.

Property taxation: active solar energy systems.

Establishes a sunset for the active solar energy exclusion on January 1, 2027. Allows prequalified solar energy systems to remain excluded until ownership changes. Sets a three-year filing window and requires forms to claim exclusions.

Property taxation: active solar energy systems.

Establishes a sunset for the active solar energy exclusion on January 1, 2027. Allows prequalified solar energy systems to remain excluded until ownership changes. Sets a three-year filing window and requires forms to claim exclusions.

Sales and Use Tax Law: exemptions: firefighting equipment.

Exempts fire departments from state sales tax on firefighting equipment and vehicles from July 2026 through 2030. Covers a wide range of purchases including vehicles, protective gear, and communication equipment. Requires fire departments to provide retailers with exemption certificates for qualifying purchases. Maintains existing local sales taxes and excludes university fire departments from the exemption.

Sales and Use Tax Law: exemptions: firefighting equipment.

Exempts fire departments from state sales tax on firefighting equipment and vehicles from July 2026 through 2030. Covers a wide range of purchases including vehicles, protective gear, and communication equipment. Requires fire departments to provide retailers with exemption certificates for qualifying purchases. Maintains existing local sales taxes and excludes university fire departments from the exemption.

Deceptive practices: service members and veterans.

Prohibits charging excessive fees for veterans benefits claims and services beyond VA-accredited rates. Bans unauthorized access to military credentials and veterans' benefit systems. Requires clear disclosures in advertisements targeting veterans about non-affiliation with VA. Makes violations a misdemeanor punishable by up to one year in jail and $1,000 fine.

Deceptive practices: service members and veterans.

Prohibits charging excessive fees for veterans benefits claims and services beyond VA-accredited rates. Bans unauthorized access to military credentials and veterans' benefit systems. Requires clear disclosures in advertisements targeting veterans about non-affiliation with VA. Makes violations a misdemeanor punishable by up to one year in jail and $1,000 fine.

Property tax: documentary transfer tax: exemptions: Native American tribes.

Exempts tribal land conservation properties from property taxes through 2032 to promote environmental preservation. Eliminates documentary transfer taxes on tribal land return transactions through 2031. Requires tribes to maintain conservation management plans and restrict land to non-commercial uses. Mandates annual reporting on exempted transactions and acreage to measure program effectiveness.

Property tax: documentary transfer tax: exemptions: Native American tribes.

Exempts tribal land conservation properties from property taxes through 2032 to promote environmental preservation. Eliminates documentary transfer taxes on tribal land return transactions through 2031. Requires tribes to maintain conservation management plans and restrict land to non-commercial uses. Mandates annual reporting on exempted transactions and acreage to measure program effectiveness.

Income tax: credit: immigration.

Establishes a state tax credit of up to $675 for filing federal immigration petitions for family members. Limits eligibility to individuals earning under $120,000 or joint filers earning under $250,000 annually. Allows unused credit portions to be carried forward for up to seven years if exceeding annual tax liability. Program runs from 2026 through 2031 with one credit allowed per taxpayer annually.

Income tax: credit: immigration.

Establishes a state tax credit of up to $675 for filing federal immigration petitions for family members. Limits eligibility to individuals earning under $120,000 or joint filers earning under $250,000 annually. Allows unused credit portions to be carried forward for up to seven years if exceeding annual tax liability. Program runs from 2026 through 2031 with one credit allowed per taxpayer annually.

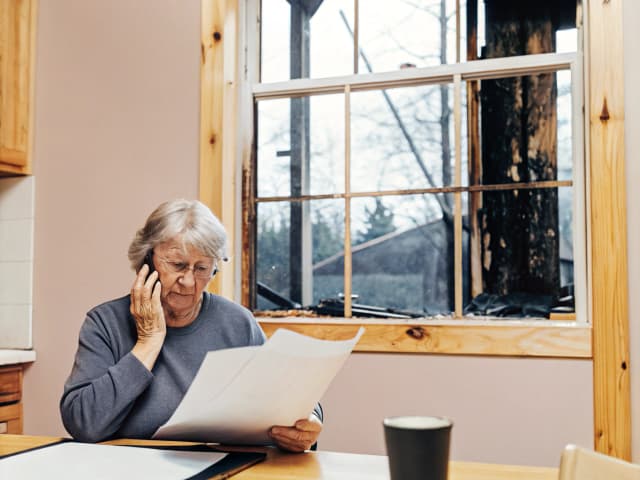

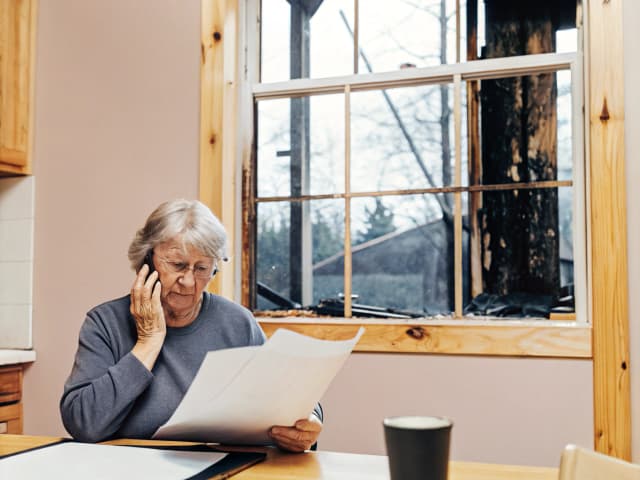

Property taxation: redemption: permanent installment plan.

Expands property tax payment deferrals during disasters to include taxpayers who have applied for installment plans. Allows one-year payment deferrals in counties declared as disaster areas by the Governor. Requires taxpayers to prove substantial disaster damage and apply by September 1 of the following fiscal year. Maintains interest charges on deferred payments which must be paid with the delayed installments.

Property taxation: redemption: permanent installment plan.

Expands property tax payment deferrals during disasters to include taxpayers who have applied for installment plans. Allows one-year payment deferrals in counties declared as disaster areas by the Governor. Requires taxpayers to prove substantial disaster damage and apply by September 1 of the following fiscal year. Maintains interest charges on deferred payments which must be paid with the delayed installments.

Motor Vehicle Fuel Tax Law: adjustment suspension.

Authorizes the Governor to suspend annual gas tax increases if they burden low-income and middle-class families. Requires the Governor to notify Legislature by January 10 before suspending any scheduled tax increase. Mandates alternative funding proposals to maintain transportation funding if tax increases are suspended.

Motor Vehicle Fuel Tax Law: adjustment suspension.

Authorizes the Governor to suspend annual gas tax increases if they burden low-income and middle-class families. Requires the Governor to notify Legislature by January 10 before suspending any scheduled tax increase. Mandates alternative funding proposals to maintain transportation funding if tax increases are suspended.

Winter Fires of 2025: real property tax: exemptions and reassessment.

Extends base-year value transfer window to eight years for listed fires. Expands local reassessment authority with extended filing window for disasters. Expands veteran exemption amounts and adds disaster reconstruction eligibility. Creates temporary use-based exemption for disaster-damaged property with 2033 sunset.

Winter Fires of 2025: real property tax: exemptions and reassessment.

Extends base-year value transfer window to eight years for listed fires. Expands local reassessment authority with extended filing window for disasters. Expands veteran exemption amounts and adds disaster reconstruction eligibility. Creates temporary use-based exemption for disaster-damaged property with 2033 sunset.

Property taxation: homeowners’, veterans’, and disabled veterans’ exemptions.

Allows veterans to claim both homeowners' and veterans' property tax exemptions starting January 2027. Requires voter approval through a constitutional amendment on the November 2026 ballot. Prohibits state reimbursement to local agencies for lost property tax revenue. Takes effect immediately as a tax levy upon passage of the bill.

Property taxation: homeowners’, veterans’, and disabled veterans’ exemptions.

Allows veterans to claim both homeowners' and veterans' property tax exemptions starting January 2027. Requires voter approval through a constitutional amendment on the November 2026 ballot. Prohibits state reimbursement to local agencies for lost property tax revenue. Takes effect immediately as a tax levy upon passage of the bill.

Veterans’ benefits: farm and home purchase.

Makes technical changes to definitions in the Veterans' Farm and Home Purchase Act program.

Veterans’ benefits: farm and home purchase.

Makes technical changes to definitions in the Veterans' Farm and Home Purchase Act program.

Property taxation: transfer of base year value: disaster relief.

Authorizes counties to extend the property tax base value transfer period from 5 to 8 years after disasters. Applies to properties damaged by disasters declared between January 2025 and January 2030. Requires counties to pass local ordinances to implement the extended transfer period. Prohibits state reimbursement to counties for any resulting property tax revenue losses.

Property taxation: transfer of base year value: disaster relief.

Authorizes counties to extend the property tax base value transfer period from 5 to 8 years after disasters. Applies to properties damaged by disasters declared between January 2025 and January 2030. Requires counties to pass local ordinances to implement the extended transfer period. Prohibits state reimbursement to counties for any resulting property tax revenue losses.

Property tax: change in ownership: residential rental property.

Exempts rental property transfers to tenant-owned cooperatives from property tax reassessment if specific conditions are met. Requires at least 51% of tenants to participate in ownership through voting shares or membership interests. Provides housing cooperatives a two-year grace period to achieve required tenant participation levels. Mandates annual reporting and documentation requirements for qualifying housing cooperatives.

Property tax: change in ownership: residential rental property.

Exempts rental property transfers to tenant-owned cooperatives from property tax reassessment if specific conditions are met. Requires at least 51% of tenants to participate in ownership through voting shares or membership interests. Provides housing cooperatives a two-year grace period to achieve required tenant participation levels. Mandates annual reporting and documentation requirements for qualifying housing cooperatives.

Personal Income Tax Law: exclusions: guaranteed income pilot programs.

Extends tax exemption for guaranteed income pilot program payments through July 2031. Provides continued financial relief to vulnerable Californians receiving pilot program payments. Takes effect immediately upon passage as a tax levy.

Personal Income Tax Law: exclusions: guaranteed income pilot programs.

Extends tax exemption for guaranteed income pilot program payments through July 2031. Provides continued financial relief to vulnerable Californians receiving pilot program payments. Takes effect immediately upon passage as a tax levy.

Real property tax: Personal Income Tax Law: homeowners’ exemption: renter’s credit.

Increases property tax exemption from $7,000 to $50,000 for homeowners aged 62 and older starting in 2026. Raises the renter's tax credit to $550 for qualified joint filers and $275 for individuals aged 62 and older. Requires local governments to implement changes without state reimbursement for lost tax revenue. Takes effect immediately as a tax levy with benefits beginning in 2026.

Real property tax: Personal Income Tax Law: homeowners’ exemption: renter’s credit.

Increases property tax exemption from $7,000 to $50,000 for homeowners aged 62 and older starting in 2026. Raises the renter's tax credit to $550 for qualified joint filers and $275 for individuals aged 62 and older. Requires local governments to implement changes without state reimbursement for lost tax revenue. Takes effect immediately as a tax levy with benefits beginning in 2026.

Tax Equity Allocation.

Modifies property tax distribution formulas to increase funding for qualifying California cities. Removes certain property tax revenue reductions that previously decreased city allocations. Requires a two-thirds legislative majority for passage due to changes in property tax allocation. Mandates state reimbursement to local agencies for new administrative costs.

Tax Equity Allocation.

Modifies property tax distribution formulas to increase funding for qualifying California cities. Removes certain property tax revenue reductions that previously decreased city allocations. Requires a two-thirds legislative majority for passage due to changes in property tax allocation. Mandates state reimbursement to local agencies for new administrative costs.

Motor Vehicle Fuel Tax Law: suspension of tax.

Suspends California's motor vehicle fuel tax for one year to provide immediate relief at the gas pump. Requires fuel sellers to pass all tax savings to consumers and show tax amounts on receipts. Transfers funds from the state's General Fund to maintain transportation funding during suspension. Establishes penalties for businesses that fail to pass tax savings to consumers.

Motor Vehicle Fuel Tax Law: suspension of tax.

Suspends California's motor vehicle fuel tax for one year to provide immediate relief at the gas pump. Requires fuel sellers to pass all tax savings to consumers and show tax amounts on receipts. Transfers funds from the state's General Fund to maintain transportation funding during suspension. Establishes penalties for businesses that fail to pass tax savings to consumers.

Veterans.

Establishes a new Veteran Task Force to prevent military veterans from leaving California. Creates a diverse coalition of 25 state agencies and organizations to examine veteran benefits and support. Requires evaluation of housing, childcare, taxation relief, and job assistance for veterans and their families. Task force members serve without compensation to develop retention strategies for veterans.

Veterans.

Establishes a new Veteran Task Force to prevent military veterans from leaving California. Creates a diverse coalition of 25 state agencies and organizations to examine veteran benefits and support. Requires evaluation of housing, childcare, taxation relief, and job assistance for veterans and their families. Task force members serve without compensation to develop retention strategies for veterans.

Veterans’ preferences: eligible spouses.

Expands state employment preferences to include active duty service members and their spouses. Requires top ranking for veterans and active duty members who pass civil service entrance exams. Allows employers to grant hiring preferences to spouses of veterans and active service members. Permits commanding officers to verify military status for preference eligibility.

Veterans’ preferences: eligible spouses.

Expands state employment preferences to include active duty service members and their spouses. Requires top ranking for veterans and active duty members who pass civil service entrance exams. Allows employers to grant hiring preferences to spouses of veterans and active service members. Permits commanding officers to verify military status for preference eligibility.